Briefly Explain the Different Types of Insurance Organisation

-Bank is an institution that deals with money and credit. Anyone can be a victim of critical illness unexpectedly.

Insurance Definitions Features

Several types of inventories are maintained by organizations.

. The important features of a sole-proprietary organization include the following. Organizations with this sort of culture can be thoroughly pleasant places to work. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity.

Each of the three levelsinstitutional administrative and technical coreis associated with a particular type of plan. Next lets look at the different types of files you can use to either create save store or send professional documents. Below weve loosely categorized these types of employee benefits and given a basic definition of each.

Different Types of Meetings in an Organisation Meetings Based On Projects. Briefly explain the following payment methods. 16 types of employee benefits you should consider.

Medical Insurance is one of the insurance policies that cater for different type of health risks. -Your family gets a lump-sum amount in the case of your death. Describe the incentives created by the different payment methods and their impact on provider risk.

The following types of companies or professions are better fits for organizing as a sole proprietorship. When determining which type of organization to take on there are several factors that should be taken into account. There are different types of organizations that a company can adopt such as functional flat matrix and divisional organizations.

There are four types of organizational structures. As revealed in the three types of hierarchical plans are strategic administrative and operating technical core. There are four major types of employee benefits many employers offer.

Increased interest amounts insurance premiums taxes etc. Explain the impact of healthcare reform on insurance and. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

- Your family receives a certain sum of money after your death. Whole Life Insurance -It covers you for a lifetime. Advertisement Remove all ads.

However the atmosphere might repel the sort of employees who focus on details and results and the emphasis on people above all else might mean that these companies struggle to grow. The insured gets a medical support in case of medical insurance policy. Medical insurance life insurance disability insurance and retirement plans.

Some of the major inventories are. Describe the purpose and organization of managed care plans. Raw materials required for production of finished products are one of the basic components of inventory for a manufacture.

JPEG PNG GIF PDF. Thus the risks of business are borne by. There are primarily seven different types of insurance policies when it comes to life insurance.

Organizations can be viewed as a three-layer cake with its three levels of organizational needs. One person is the owner in a sole-proprietary form of organisation. Explain Different Types of Banks.

Organizational Behavior Organizational Structure Structures. Shortage of raw materials can. Explain the different types of generic payment methods.

- Organisation of Commerce and Management. Charge based discounted charges. And rising medical expense is of great concern.

Different types of organizational structures. -It covers you for a specific period. The insurance is not only a protection but is a sort of investment because a certain sum is returnable to the insured at the death or the expiry of a period.

Three such most commonly used plans are hierarchical frequency-of-use repetitiveness and contingency plans. These types of gatherings are meant to bring together people from different parts of organization working on a common task like working on some new concept or product or reorganization of the business. On the other hand if your business operates in an industry where personal liability is.

Heres a list of some of the most common file types youll encounter in the professional world. Types of organizational structures. A medical insurance considered essential in managing risk in health.

For those sole proprietorships a good business insurance policy would shield against most issues. The proprietor is the sole beneficiary of profits in this form organisation. Term Plan - The death benefit from a term plan is only available for a specified period for instance 40 years from the date of policy purchase.

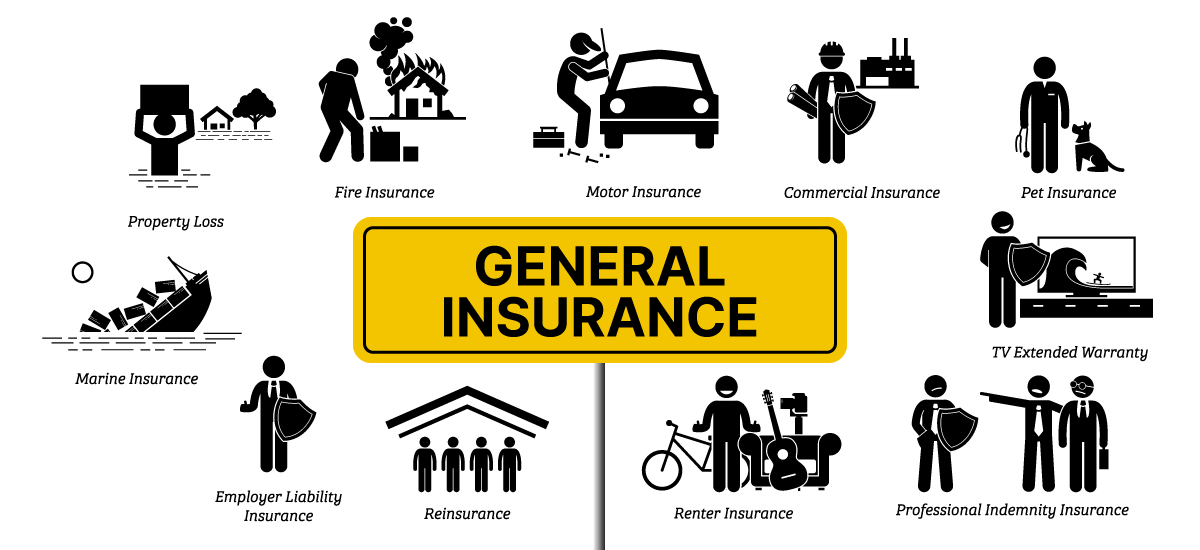

Many different types of plans are adopted by management to monitor and control organizational activities. General insurance includes Property Insurance Liability Insurance and Other Forms of Insurance. Term Insurance -It is the most basic type of insurance.

If there is a loss he alone has to bear it. The whole doc is available only for registered users. Now you know a little more about the different document types youre company is likely to deal with.

The three hierarchical plans are interdependent. Get a custom sample essay written according to your requirements urgent 3h delivery guaranteed. The four types are.

Plans commit the various resources in an organization to specific outcomes for the fulfillment of future goals. A fee-for-service reimbursement method. Understanding how they work and what their benefits and drawbacks are can help you make a more informed decision as to which to implement in your workplace.

-If however you survive the term no money will be paid to you or your family. Explain different types of banks. A limited time offer.

It accepts deposits from the public and grants loans and advances to those who. The Culture of Authority. Insurance is a means of protection from financial loss.

Briefly describe the third-party payer system.

Insurance Correspondence Types Of Insurance Principles Characteristics

Org Chart Best Practices For Effective Organizational Charts Organizational Chart Org Chart Organization Chart

Free Insurance Sales Business Plan Template Example Business Plan Outline Business Plan Template Pdf Business Proposal Template

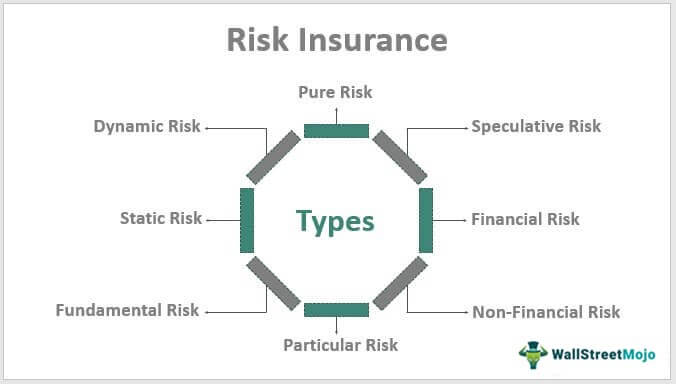

Risk Insurance Definition Top 8 Types Of Risks In Insurance

Life Insurance Types Of Life Insurance Policy In India 2022

Non Life Insurance Policy Types Features And Benefits

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Types Of Life Insurance Policies In India

Life Insurance Types Of Life Insurance Policy In India 2022

The History Of Global Warming Geography Social Studies Printable And Digital Global Warming Social Studies Printables Teaching Geography

4 Types Of Insurance Policies Everyone Needs

Insurance Concept Principles Functions Of Insurance Company Q A

Infographic Most Important Insurance You Need Infographic Life Management Insurance

Insurance Hazards Physical Hazards And Moral Hazards Examples

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Product Costing Cost Accounting Financial Strategies Budgeting Money

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)